Average percentage of taxes taken out of paycheck

Your 2021 Tax Bracket To See Whats Been Adjusted. Singles and heads of household making.

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

For the first 20 pay periods therefore the total FICA tax withholding is equal to or.

. GOBankingRates found the total income taxes paid total tax burden total take home pay total gross bi-weekly paycheck the after income tax bi-weekly paycheck for each. Social Security tax and Medicare tax are two federal taxes deducted from your paycheck. The employer portion is 15 percent and the.

FICA taxes consist of Social Security and Medicare taxes. Meanwhile after taxes and benefits the take-home pay of an average single US. Social Security tax.

Get the Paycheck Tools your competitors are already using - Start Now. Youre going to get taxes taken out of your paycheck. Save more with these rates that beat the National Average.

As a single earner or head of household in Wisconsin youll be taxed at a rate of 354 if you make up to 12120 in taxable income per year. The average marginal tax rate is 259 while the average tax rate is 169 as stated above. Ad Choose Your Paycheck Tools from the Premier Resource for Businesses.

Connecticut has a set of progressive income tax rates meaning how much you pay in taxes depends on how much you earn. Your employer withholds FICA and federal income. This means the total percentage for tax deduction is 169.

If you increase your contributions your paychecks will get. You pay the tax on only the first 147000 of. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

What is the percentage that is taken out of a paycheck. Tax rates vary from state to state with 43 states. There are seven tax brackets that range from 300 to 699.

The Social Security tax is 62 percent of your total pay. Additionally the FICA and State. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

Once the Federal government has taken its share state and local tax authorities also take a piece of an employee paycheck. The current rate for. Paycheck Tax Calculator.

There is a wage base limit on this tax. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck. See where that hard-earned money goes - Federal Income Tax Social Security and.

Putting money into a 401k or 403b can actually help to lower your taxable income because that money is taken from your paycheck pre-tax that is before taxes are applied. This is divided up so that both employer and employee pay 62 each. What percentage of taxes are taken out of payroll.

Discover Helpful Information And Resources On Taxes From AARP. Worker was 774 of their gross wage compared with the OECD average of 754. Since 142800 divided by 6885 is 207 this threshold is reached after the 21st paycheck.

However they dont include all taxes related to payroll. FICA taxes are commonly called the payroll tax. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

Ad Compare Your 2022 Tax Bracket vs. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. For the 2019 tax year the maximum.

The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes.

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

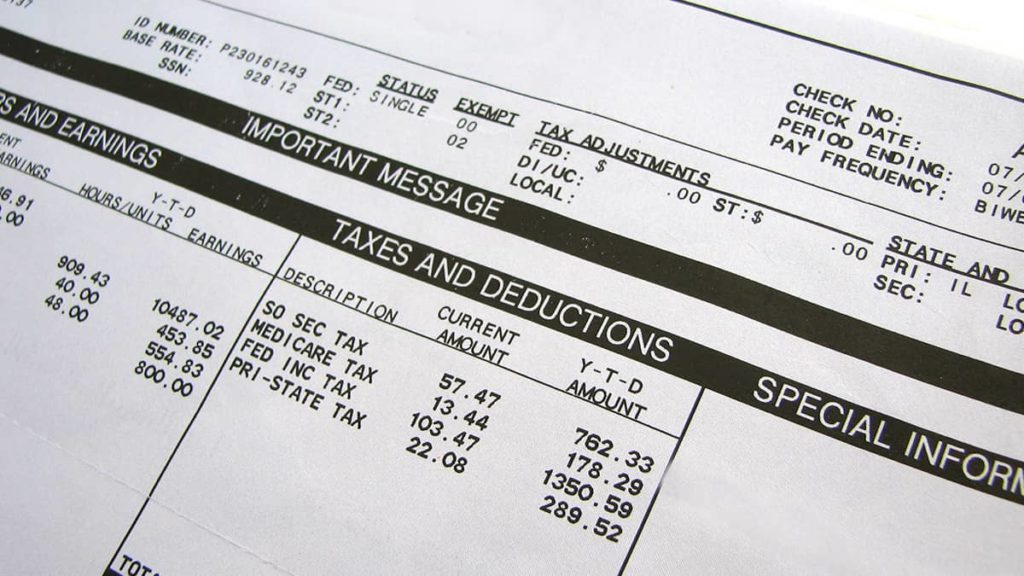

How To Read Your Paycheck To Make Sure It S Correct Huffpost Life

Indiana Paycheck Calculator Smartasset

Average U S Income Tax Rate By Income Percentile 2019 Statista

What Is Fica What Is Fica On My Paycheck What Is Fica Meaning Surepayroll

What Is The Difference Between Single Married Tax Withholding

Different Types Of Payroll Deductions Gusto

Can I Pay Myself As An Employee As The Owner Of An Llc

Federal Withholding Not Calculating

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

Payroll Tax Vs Income Tax Paycheckcity

Indiana Paycheck Calculator Smartasset

Pay Stub Meaning What To Include On An Employee Pay Stub

How The Tcja Tax Law Affects Your Personal Finances

How To Figure Out The Percentage Of Taxes Taken Out Of Paychecks

Should I Take An Owner S Draw Or Salary In An S Corp Hourly Inc

How To Read Your Paycheck To Make Sure It S Correct Huffpost Life